Protect Tomorrow, Flexibly Manage Wealth with Indexed Universal Life

Discover Flexible Life Insurance with Indexed Universal Life – Secure Your Financial Future and Grow Your Wealth, No Matter What Life Throws Your Way!

Explore Flexible Life Insurance Solutions Tailored for You

Explore flexible life insurance solutions tailored to safeguard your future. Our services adapt to your evolving needs, ensuring security and growth for peace of mind.

Flexible, Secure Insurance Solutions for Tomorrow

Flexible, market-linked life insurance solutions for secure financial futures.

Flexible Premium Life Coverage

Indexed Universal Life Insurance Policies offer life coverage with potential cash value growth based on specific market index performance, without direct market risk exposure.

Adjust Premiums Flexibly

Adjust premiums to suit changes in your financial circumstances, ensuring your coverage remains active while accommodating your economic situations.

Cash Access Options

Access your policy's cash value for urgent financial needs or significant expenses, offering you flexible financial options when necessary.

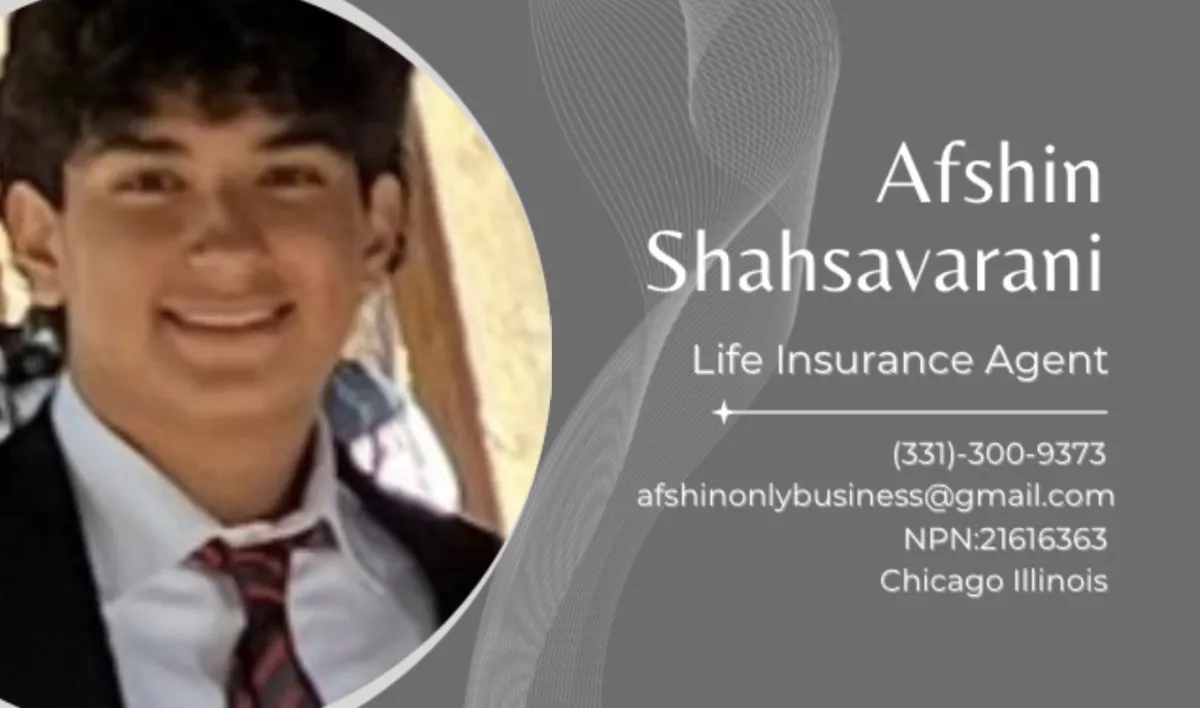

Assisting Agent

Afshin helps families and business owners build smarter financial plans using Indexed Universal Life (IUL) — balancing protection, growth, and long-term goals. Every plan is custom-built to make sure your life insurance works for you.

Testimonials

Jasmine Richards

The Agent helped me and my business partners structure the IUL to fund our business to make sure we have enough funds available, never turned back!

Monica Chandler

Switched to Indexed Universal Life for the flexible premiums and loan options. Easiest adjustments I’ve made, definitely beats other policies I've tried. No regrets.

Thomas Krazinski

Estate planning made smoother with Indexed Universal Life. Their approach simplified transferring my wealth and minimizing tax impacts. Appreciate the straightforward process.

FAQs

Answers to Help You Understand Your Policy Better

What distinguishes Indexed Universal Life insurance from other policy types?

Indexed Universal Life combines flexible premiums with the potential for cash value growth tied to a market index.

How is the cash value in an Indexed Universal Life policy affected by market changes

The cash value can increase based on a chosen indexs performance, but has a floor to prevent loss during market downturns.

Can I change my premium amounts after the policy has started

Yes, you can adjust your premium payments as your financial situation changes, ensuring flexibility.

Are there any limits to how much I can withdraw or loan from my policy?

You can generally make withdrawals or loans up to the available cash value amount in your policy. However, it's important to consider that withdrawals and loans can reduce the death benefit and potentially the overall value of the policy.

What happens if I surrender my Indexed Universal Life policy?

If you surrender your policy, you receive the current cash value minus any surrender charges applicable.

How does an Indexed Universal Life policy aid in estate planning?

These policies can be structured to provide a tax-efficient death benefit to heirs, helping manage estate taxes and providing liquidity for estate settlements. Plus, with its flexible coverage options, it supports dynamic long-term planning.